8/2023 (Updated) - Update of

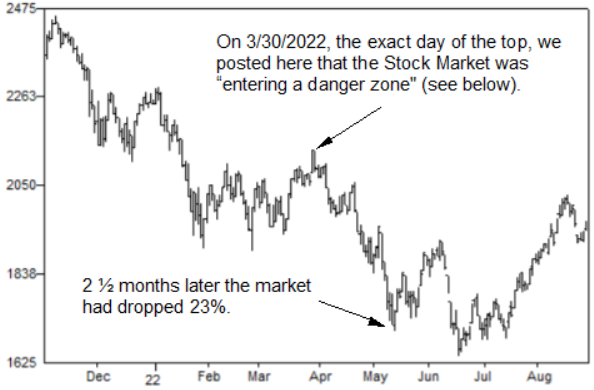

Forecast RUT Top- On 3/30/2022 (See Below) we forecast that the

Stock Market was "Approaching a High Risk Zone". This post was

the exact top of the market with strong upward momentum.

3/30/2022

- Approaching High Risk Zone. The 3/12 post showed the New

Moon (8-week cycle) in the RUT. This post updates that cycle to

the present because the next New Moon arrives very soon.

As the below chart shows, the quarter-cycle (0-90)

following the New Moon is some of the most destructive. You can

add the quarter-cycle by clicking the "Add a Cycle" icon on the

left tool bar and changing the Delta to 90.

CycleTimer settings: Geocentric; Delta = 360; Orb = 0; Synodic

Moon and Sun

3/12/2022

-

The 2/8/2022 post showed the New Moon in the SP500 covering

a 6 month period. We now expand that to one year in the Russell

2000. This index is good to demonstrate lunar cycles due to its

sideways choppy action. An index showing a strong directional

trend (such as the SP500) will overwhelm the smaller cycles.

These cycles occasionally invert top-to-top (note 3/13/2021).

This happens due to cycle alignment at the equinox (a topic for

another day).

CycleTimer settings: Geocentric; Delta = 360; Orb = 0; Synodic

Moon and Sun

3/12/2022

-

We now add a second cycle to our chart. The only change to

make is Delta=180. This will plot all New and Full Moons. Very

few of these arrived uneventfully. And if given a tolerance of

+/- one day, every cycle aligned with a tradable turn.

CycleTimer settings: Geocentric; Delta = 180; Orb = 0; Synodic

Moon and Sun

2/12/2022 -

Using CycleTimer to Time SPY Intraday

The 2/8 post used the New Moon (Sun-Moon conjunction) to

time the SPX on daily charts. The Moon is also used for intraday

timing. This chart shows 5 days of the SPY last week using 5

minute bars. Because the Earth rotates one degree in about 4

minutes you can use 4 minutes bars for more precision.

CycleTimer Settings: Topocentric, New York, Delta=60, #Cycles=1,

Synodic, Moon-Midheaven

Each of the cycle starting points is a strong natural angle,

either 90 or 120 degrees apart. 60 degrees of Earth rotation

(relative to the Moon) from this starting point was another

turn. Last week they were all tradable tops.

2/8/2022 -

Using CycleTimer to Find the New Moon Trigger Points

On 2/25/2015 we posted the time cycle in the RUT that turns

on the first of the month. This cycle is further refined by

using the New Moon. CycleTimer calculates all cycles to within

1/1000 arc second, which is helpful for intraday charts and

Topocentric settings.

CycleTimer settings for below cycle: Geocentric; Delta = 360;

Orb = 0; Synodic Moon and Sun.

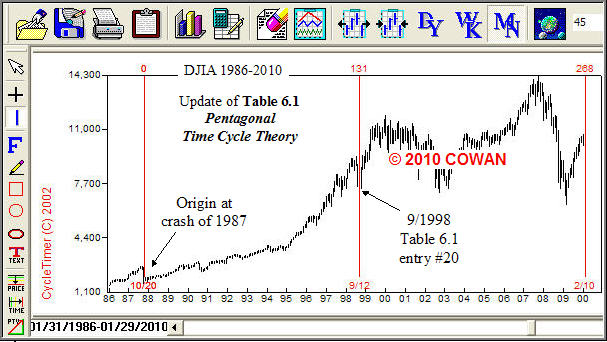

3/21/2020 - Based on page 55 of

Cowan's Pentagonal

Time Cycle Theory. Cowan showed that Saturn-Uranus cycles

repeat in the same zodiacal locations (plus one 30 degree sign) every 90

years. These first order recurrences marked the 1929 and 2020

tops. Saturn-Uranus cycles repeat on the opposite side of the zodiac

every 45 years. These second order recurrences, same angle

opposite zodiac location, marked the 1975 bottom.

The 1930's depression was worsened by misguided government fiscal

policies. The 2020's version of destructive government intervention is

forced closures of thousand of businesses for "safe space". Many of

these businesses will never recover.

The Geocentric perspective below shows Saturn-Uranus approaching the

ominous 90 degree angles at the 1929-1930 and 2020 tops. This chart

measures Saturn-Uranus delta 90 from the 2020 top. This includes

conjunctions and oppositions. Every recurrence for the past 100 years

was significant, and lasted much longer than expected.

2/29/2020 - The most recent plunge

in stocks has coincided perfectly with Cowan's cycles, as

published in his books and articles. The below chart uses CycleTimer

software to calculate the 15 degree Jupiter-Uranus cycle

measured from the 12/25/2018 low. It coincided perfectly with

the August 1, 2019 and February 2020 drops.

2/3/2018 - On 9/2017 (see below) Dawa Raju of India

submitted his Elliott Wave analysis of the SP500 using CycleTimer

software. In this chart he updates that analysis to present. His

original analysis showed potential resistance when Wave 5 = Wave 1. His

current chart shows that the most recent top occurred when Wave 5 = Wave

3.

The broad based NYA shows:

Wave 5 = Wave 3 = Wave 1

Wave 2 = Wave 4 = 50% correction of preceding wave.

9/23/2017 - This chart was submitted

by Dawa Raju of India. He is a long time student of Gann and Cowan. It

is his analysis of the Elliott Wave and Fibonacci structure of the

SP500 using CycleTimer

software.

5/20/2017

-

CycleTimer analysis using Cowan techniques

shows the astro alignment in July to be very dangerous.

Read the complete article.

12/11/2016 -

Has the 17-Year Cycle Bottomed?

Shortly after the November, 2016 bottom we posted that a major

bull advance was under way. Six months later the market has rocketed

higher than anyone expected (except Stock Market Geometry).

1/18/2016 -

Bradley F. Cowan

published

Pentagonal Time Cycle Theory in 2009 where he forecast

late 2016 as a major stock market bottom.

His based this forecast on the pentagonal subdivision of the 84-year

cycle into five smaller 17-year cycles.

The chart below updates the lunar cycle and Price by Degree

posted last year. The most recent

top coincided perfectly with prices arriving at the intersection of

these 2 lines.

9/10/2015 - In May we began posting

(see below) several charts warning that the Russell 2000 was up against

Gann's Price x Degree. In July prices backed away from that resistance

line for the last time and collapsed.

The chart below shows the same Gann Price x Degree in the SP500. Prices

rallied back up this resistance line at the 50% retracement. Also shown

on this chart is a proprietary lunar cycle that coincides with market

tops.

6/9/2015 (Chart Updated Again 6/15) - One month ago we posted

(below) a chart of the Russell 2000 with Gann's Price by Degree. Since

then, prices advanced back up to exactly touch that line and retreated.

(Since 6/9 prices have again bounced off the Price x Degree).

5/9/2015 - The efficacy of Gann's "Price by Degree" in

timing the SP500 has been well documented over the past year in the

below posts. This same tool also timed the 4/27/2015 top in the Russell

2000. Since October 2014 the Russell had been following a linear trend

until running into the Price x Degree. This top also coincided with the

cycle shown below in the 2/25 post.

2/25/2015 - Sometimes a simple

static cycle is all you need. This chart shows a 2-month top-to-top

cycle in the RUT for the past year. The start of every other month has

seen selling.

1/8/2015 (Chart updated again 1/31/15) - This chart

updates the two Gann lines previously shown in the SP500. Key areas

since the last post are circled. A picture is worth 1000 words!

12/13/2014 On 11/28 (see below) SMG staff posted that

the SP500 had reached balance at the upper Gann Angle defining the trend

since 2009. The warning was also given that the time count was at the

critical 144 multiple that defined the duration of the 1994-2000 move.

Prices have since dropped back down to the Price x Degree line first

disclosed by Mr. Cowan in 2012.

11/28/2014

- Anyone studying Cowan or Gann's works are familiar with the

importance of 144. The total number of trading days during the 1994-2000

move was 1447. From the 2009 bottom through today it is 1444.

The trend has followed Gann's 45 degree angle since the

2009 bottom, or one point per trading day. This angle represents the

balancing of price and time. CycleTimer owners can play with this angle

from various tops to find its exact location now.

11/4/2014 - This

chart updates the SP500 with the previously shown WD Gann Price by

Degree. Added to this chart are the 270 and 180 degree lines, which exactly

defined the recent bottoms. CycleTimer owners can reproduce these lines

by formatting to subdivide by 4. Doing this creates the "Squares".

10/1/2014 - On 8/30/2014 SMG

staff posted WD Gann's Price by Degree for the SP500 on a 15-year

monthly chart (see below). When combined with the 3rd 666 square off the

2009 bottom the trend reversed.

8/30/2014 - Below is

an update of the chart sent to CycleTimer owners in 12/2012 showing WD

Gann's Price by Degree. CycleTimer owners are encouraged to repeat this

calculation.

4/2014 - "The smallest complete cycle is five years."

..WD Gann Master Courses

In Four-Dimensional Stock Market

Structures and Cycles Cowan identified the Saturn 5-Year cycle

using data back to the 1700's. The below chart uses CycleTimer to

automatically calculate that cycle anchored at the 3/2000 top in the

NASDAQ.

The middle chart zooms in on the 2009-2014 5-Year Saturn cycle and adds

Cowan's 5-Year Venus-Earth cycle. The bottom chart zooms in further on

the top using daily data.

1/24/2014 - If you want to

understand the January 2014 Stock Market drop look at Cowan's 2013+

Forecast (Page 4) which listed 1/18/2014 as a major cycle. He showed

this natural cycle recurred at the tops in 8/1987, 1/1994, 2000, and

2008.

11/2013- In late December 2012

Mr. Cowan's 2013+ forecast was sent to

CycleTimer owners. It listed 3 dates as critical in 2013, May

21 & 28, Mid-August, and October. The below chart of the DJIA

shows the results.

7/2013 - Four and a half years

ago, Cowan published

Pentagonal Time Cycle Theory where he presented his

independently discovered market cycle equation, based on the Square of

Twelve. He used that equation, anchored 50 years in the past, to

project the two cycle top dates shown below. In December, 2012 owners of

CycleTimer software received his Market Forecast, which again forecast

these exact dates as the top. That same newsletter included WD Gann's

PricexDegree of the Moon's North Node used as price target. When these

cycles and resistance lines met, circled below, the top was reached in

both price and time.

If you thought you were saving a few dollars by not buying CycleTimer

and not receiving his forecast you were "Penny Wise But Pound Foolish".

The few dollars spent would have been easily made in just a few hours

shorting this market on Cowan's dates.

Update of Chart Cowan Presented to CycleTimer Owners in

December 2012

6/9/2013

- WD Gann's Price by Degree

CycleTimer owners who received Mr. Cowan's Market

Forecast were presented in December with a chart of the SP500 and WD

Gann's Price

by Degree using the Moon's North Node. CycleTimer Intraday is used to

update that chart below.

6/2/2012

5/5/2012 - You Were Warned!

2

1/2 years ago, Cowan used his unique and independently discovered

methods of cycle analysis to publish in

Pentagonal Time Cycle Theory (p. 48 & 104) that May 2012 would be a

major stock market cycle top. When the first top arrived real-time Cowan

posted here (see 3/28 post below) warning again that a top was complete.

He used this as a teaching opportunity to show how easily anyone can use

his PTV to time market turns with the assistance of

CycleTimer software. The technique was so simple and the

results so undeniable that anyone unable to effectively use these

techniques should not be trading, nor do their opinions merit attention.

4/12/2012 - Cowan Nailed SP Top Using His PTVs With

Accuracy of 0.8%

Two weeks ago, at the top, Cowan identified the top using his PTVs (see

below). Since then, the largest two week decline of the year has

occurred. The

accuracy of his PTV projection was better than 1%, which is well within

the resolution of the SP500 data. His simple PTV forecast was: 302.37 x

1.5 = 454.55. The top hit at PTV=457.4, which is 0.008 from the

forecast. Proving once again with REAL TIME forecasts the unmatched

power of his techniques. Of course, his other techniques as well as

those of Gann can be combined with his PTV to improve this accuracy even

more.

3/28/2012 - Cowan PTVs Nailed Today's SP500 Sell-Off

Many years ago Cowan discovered the PTV (Price-Time Vector). When he published his work in

Four-Dimensional Stock Market Structures And Cycles

no one was doing anything even similar to it. Years later it continues

to work and nail market tops and bottoms with unmatched precision.

Below is the SP500 showing Gann's diagonal angles and Cowan's

corresponding PTVs. The March 16th post (below) identified the 2x1 angle

as the SP500 trend. Because of that trend the PTV tool in

CycleTimer is format with the time component x2. The PTVs

along Gann's angles are shown below and proves once again how

beautifully Cowan's techniques work. The 3/27 top in the SP is EXACTLY

1.5 times (musical fifth) the PTV from the previous top, i.e., 450/300 =

1.5..beautiful! Only readers of Cowan's work are aware of this

four-dimensional technique.

3/16/2012 - SP500 Following Gann's 2x1 on Daily Chart

The SP500 has been following the simple 2x1 Gann diagonal angle since

the August bottom.

CycleTimer users can simple format their Gann tool

for 2x1 and draw the angle to upper right. Then click on the August

bottom. You can then move the angle by clicking the Selection arrow,

click your starting point, then drag/drop. Simple and effective

technique for trend followers.

2/27/2012 - On 12/14/2011 when the QLD (Nasdaq ETF) was at 77 Cowan called the

bottom (see below). Today he closed his position for a ~40% profit in 2

months. Students of Cowan know his philosophy of "only a fool holds out

for top dollar".

2/3/2012

-

In November, 2011 Cowan showed the ellipse

containing the NASDAQ (below). Prices continued within that ellipse for

two more months until Cowan called the 12/14/2011 bottom. Two weeks

later prices gapped over the ellipse. The QLD (NASDAQ ETF) is already up

25% since Cowan called the Great Pentagram Cycle bottom.

1/3/2012

-

Once again...Cowan was dead-on accurate

with his cycle forecast posted here on 12/14/2011 (and 12/12). Today the

NASDAQ is already up 60 points as it broke out of its compression zone.

The day following Cowan's 12/12/2011 post

about BIDU it dropped from 130 to 110 (15%) in two days! He warned to

tighten stops to lock in profits because the Great Pentagram cycle was

due to bottom...It did...right on schedule as Cowan posted.

This cycle was discovered by Cowan and is taken right out of

Pentagonal Time Cycle Theory (Figure 4.1). It is reproduced below

using

CycleTimer software. So easy a retarded monkey could do it.

12/14/2011

-

Two days ago Cowan identified a triangle

that had formed in BIDU and that it was ready for a breakout. Two days

later this stock is already down 10% (130 to 116), demonstrating

real-time trading rules (buy or short when the line is crossed)

resulting in huge short-term profits.

The below chart shows how Cowan's "Great

Pentagram" cycles have worked out in the NASDAQ since he published this

cycle in

Pentagonal Time Cycle Theory.

CycleTimer software is used with "now" (12/14/2011) as the

starting date. This cycle has been dead-on accurate for over 2 years

since Cowan's publication. Market turns can be expected when this cycle

arrives at the Great Pentagram in BOTH geocentric and heliocentric .

That is why the astute trader will follow his BIDU profits down with

close stops. Simple trading techniques showing real-time how easy it is

to apply Cowan's techniques.

12/12/2011

- BIDU Has

Been Compressing Since July. Watch For Breakout.

The chart below shows 3 fractal examples of

BIDU compressing into triangles. Two completed with dramatic breakouts.

The larger third triangle (red lines) is still forming with a high

energy breakout likely after penetration of either of these lines.

Elliott Wave analysts look for 5 waves inside diagonal triangles with a

breakout to the upside. The magnitude of the breakout is typically equal

to the widest part of the triangle, in this case 65 points, or about 50%

above current levels. Either way, up or down, a breakout of the red

lines will indicate direction.

LEARN HOW COWAN FORECAST THE MAY 2011 TOP

TWO YEARS IN ADVANCE!

Nearly

two years before the recent stock market top Cowan published its

expected date in Pentagonal Time Cycle Theory (page 127). The

below chart uses

CycleTimer software to reproduce that cycle. This cycle

has special pentagonal significance only explained in Cowan's latest

book. This cycle is due to return again in 2013 with even more profound

consequences.

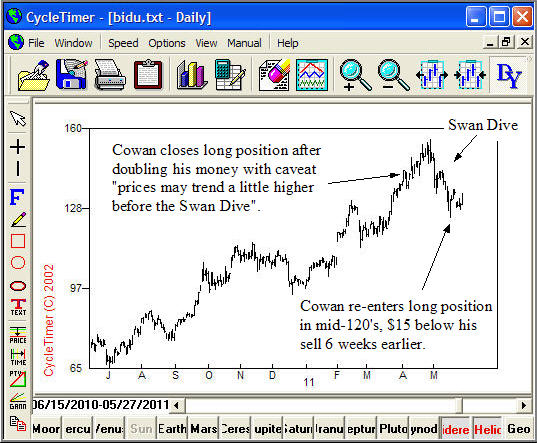

6/2/2011

-

Anyone following my 4/2/2011

advise (see below) to sell BIDU at 140 and buy back later has already made a

lot of money. As forecast, the stock trended higher into a "BULL TRAP" for a

few days until taking the Swan Dive down to 124 only 6 weeks after I sold at

139.25. I always sell into strength using market orders. As the chart below

shows, prices drop quickly from the top. My re-entry point is ~$15 below my

4/2/2011 sell price, or about 10% in 6 weeks.

4/2/2011

-

My PWER trade on November 22, 2010 was again dead on accurate. That

bottom at 8 3/4 was followed by a fast advance beyond 12 for a profit of

~40% in a little over 2 months. Because I have received several emails

asking when to sell, I am outlining simple techniques not commonly used

that any trader can learn.

Several years ago I wrote about the

Black Swan Formation and successfully demonstrated its application

in real-time trading. The Black Swan is found in all markets and is shown below in BIDU. It

consists of 3 parts; a base-building smooth bottom, a quick

mark-up in prices (neck of the swan), distribution (head of the

swan). Geometrically, this is an unfolded ellipse. The extent and

duration of the Black Swan repeats. The BIDU chart shows the same price

and time movement June-July, 2010. Each of these swans divided the

entire move shown on this chart into 1/3. The Black Swan typically

dives after it forms.

Additionally, the upper trend line since

the May 2010 stock split has defined the trend. Prices are now near this

trend line. Using these simple techniques the trader would sell knowing

that the risk/reward ratio was too high, with stops placed above the

trend line. Although prices may follow that upper trend line a little

longer, the words of the famous American whiskey bootlegger of the

1920's, Joseph Kennedy, are apropos, "only a fool holds out for top

dollar".

For these reasons and others I liquidated

my entire BIDU position yesterday at 139.25. Some was purchased at 69.5

and the rest at 99.25, nearly doubling the earlier purchase in 9 months.

I may repurchase in the future.

11/22/2010 - Effective use of technical analysis

does not have to be complicated. When a stock is in an early growth phase

linear trends and support/resistance levels are much easier to identify.

Simple methods of analysis such as Elliott 5-3 patterns can still be used

even if you have more sophisticated methods. PWER stock is a good example of

this. The daily chart for the past year shows a 5 wave up, 3 wave down

pattern with support at the linear "A" and "C" levels. My buy-in on PWER has

been in the 8.75-9 level over the past few days.

10/31/2010

-

FSLR hits Cowan's 7/3/2010 price target of 150 and plunges, proving

Cowan's forecasting techniques work in both PRICE and TIME.

On 7/3/2010 when FSLR stock was trading at

120 Cowan forecast here (see below) that it would run up to 150. That

price target has been hit twice followed both times by 10%+ drops.

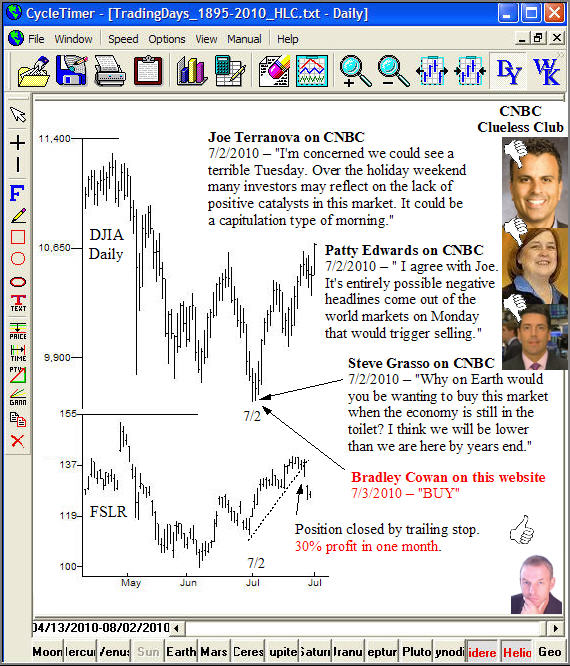

8/3/2010 -

One month ago at the 7/2/2010 bottom every

talking head on the airwaves was in full panic mode calling for a

"double dip" recession and much lower prices. (See chart below). The

CNBC Clueless Club cited the "death cross", as they called it, of the

50-day moving average crossing the 200-day. The rampant pessimism can be

seen by watching this CNBC video recorded on 7/2/2010,

www.cnbc.com//id/38058478.

While the CNBC Clueless Club was calling

for more selling, Cowan made his first BUY recommendation in 3 months,

giving FSLR stock as a good example. His accumulation price was 100-105,

and when made public on 7/3 FSLR was trading at 120. FSLR immediately

shot up to 140 three weeks later, for a quick profit of 16% from 120,

and 40% profit from 100 a month earlier! As is always the case, the

position was followed by trailing stops. This lets the market decide

when to close the position.

7/3/2010

-

FSLR stock - A textbook example of stock manipulation.

FSLR (shown below) is a good example of

smart money manipulating the public into "playing their game" by issuing

buy recommendations as they distribute their stock. FSLR had been in a

downtrend since 2007 until it was broken at $112 on high volume on March

26, 2010. The volume indicates that the smart money was buying, yet no

"buy recommendations" were issued at that time. A month later FSLR was

at 152 and 5 different brokerage firms issued "strong buy"

recommendations to the press. Volume spiked as they distributed to the

public the stock they bought a month earlier. Prices immediately tumbled

all the way back to the trend line at 100.

When you listen to "buy" or "sell"

recommendations you are playing another man's game, and you are certain

to lose. The charts never lie. All the manipulation is recorded in the

price and volume action for the sharp eye to discover.

I have been accumulating FSLR for the past

2 months whenever it drops down to the declining trend line, typically

in the 100-105 price range. Upside target is when it returns to the

October 2009 gap around 150.

3/5/2010

2/5/2010 -

COWAN LOWERS TRAILING STOP TO LOCK IN PROFITS. REVIEW BELOW POSTS

FOR COWAN'S REAL-TIME FORECASTS OF THIS DECLINE

Readers of

Pentagonal Time Cycle Theory understand that the current

decline in the stock market arrived right on time. Review the 9

degree harmonics of Table 6.1. Or, more simply, just enter 45

degrees in

CycleTimer, as shown below, with the start date at "now".

The same result is obtained by setting the cycle start date to the

reopening of the stock exchange in 12/1914, advancing at the rate

of 45 degrees. You will see the cycle originating at the crash low

of 1987 (or 1914) hit again at the 9/1998 low, and now.

1/30/2010

-

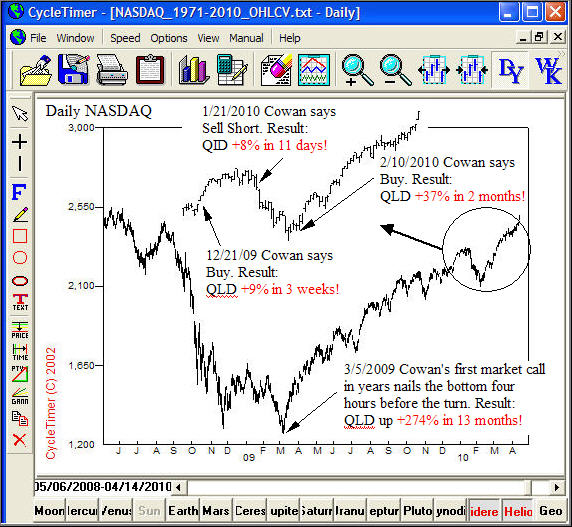

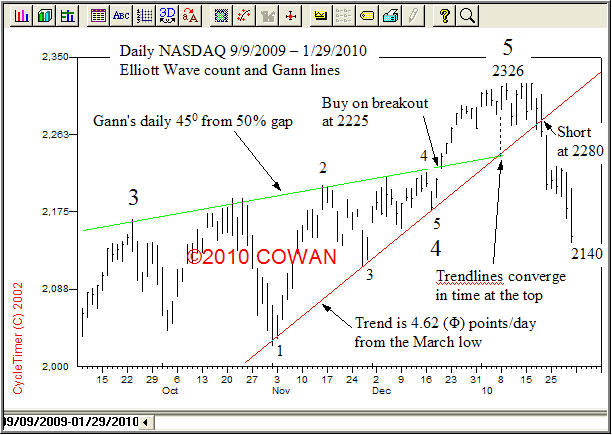

DOUBLE BULL'S EYE! - NASDAQ UPDATE

On December 21 Cowan posted (below)

the two trendlines defining the NASDAQ. He told traders to buy

when the upper 45 degree Gann line was broken followed with

trailing stops. And to short when prices fell below the lower

trendline.

The below chart updates the action since then.

DOUBLE BULL'S EYE!

Immediately after the posting, prices

completed the 4th Elliott Wave and ran up 100 points in 2 weeks.

The top was reached when the two trendlines converged in time, as

is typical of compressing 4th wave triangles. Following Cowan's

second recommendation to short when the lower trendline was broken

at 2280, traders have since accumulated another 140 points in a

little more than one week!

12/21/2009

-

NASDAQ UPDATE

Since September 2009 The NASDAQ has been compressing between two trend

lines. The upper line is the Gann 45 degree angle on the daily chart

measured from the 50% retracement gap in October 2008. Gaps typically

occur at the exact midpoint of a move. These are the points of maximum

velocity and zero acceleration. It's the same principle of simple

harmonic motion taught in physics. If a theoretical ball is dropped

through a hole drilled thru the Earth it reaches maximum velocity at the

center of the Earth. In a falling market this manifests as a gap. When

prices break out above the 45 degree angle it has overbalanced and

represents an entry point for traders followed with trailing stops. A

break of the lower trend line would similarly represent a good short

entry point

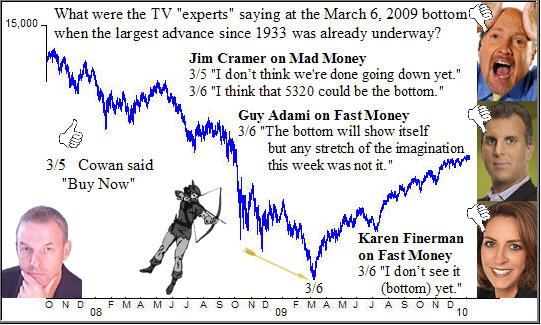

LEARN HOW COWAN CAUGHT THE FALLING KNIFE AT THE

3/6/09 BOTTOM!

The general consensus is that you don't try to "catch a

falling knife". That is, don't try to call a bottom, just trade the

trend. For most traders that is good advice. But Cowan has a proven

track record of doing just that,

calling tops and bottoms as they occur real time with uncanny

accuracy. He did it again on March 5, 2009. Using

CycleTimer software and the

techniques taught in his courses Cowan made his first public market call

in many years. He called a bottom and advised traders to buy

immediately. The post was made here FOUR TRADING HOURS before the actual

bottom and can be seen below in its original form.

Educate yourself so that you can make your

own informed decisions. If you are basing your trading or investing

decisions on anyone other than yourself you are making a huge mistake.

Just look what the so called "experts" were telling their audiences at

the bottom in March.

3/16/2009 -

COWAN RAISES STOP TO 7250 LOCKING IN 650 PTS PROFIT!

"This is a powerful long-term cycle that I explain in

Chart VIII.I in my book. It has moved exactly 180 degrees from the 1987

crash low. Anybody that has my books and didn't profit from this rally

should kick themselves. I would love to see it pull back and take out my

stop so I can buy lower. But I wouldn't be surprised if this doesn't happen

until 8000 is hit"

3/16/2009

-

Position closed BY trailing stop at 7250. Trade result IS 650PTS

PROFIT IN 7 TRADING DAYS. WILL BUY BACK LATER TO CONTINUE THIS

POWERFUL UP CYCLE.

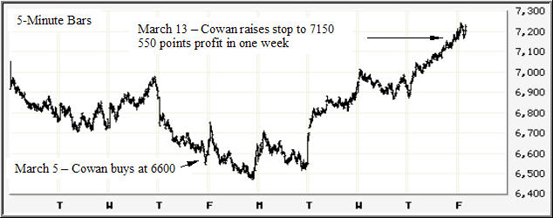

3/13/2009

-

TODAY COWAN RAISES STOP TO 7150 LOCKING IN 550 PTS PROFIT!

On 3/5/2009 when the market was below 6600 and still falling the

CNBC talking heads were cowering in fear in their makeup rooms. No

one was calling a bottom. FOUR HOURS before the actual

bottom on 3/6 Cowan made his first public forecast in many years

right here on this public web page, open for all to see, telling

investors to buy now. The original unedited posting is below.

One week later Cowan has raised his stop to 7150 locking in 550

points profit in one week! Re-entry is possible later if the stop

is taken out.

3/5/2009

- It

is Cowan's view that the recent plunge in stock market prices should not

be seen as a source of fear, rather a rare opportunity to buy quality

companies at panic low prices. Investors at these levels will thank

their lucky stars.

Many stock market cycle clusters arrive in March. One studied in the

course is the slow moving Saturn-Uranus, plotted below with

CycleTimer software, moving 180

degrees from the 1987 crash low.

![]()